1099MISC

The 1099MISC form is used to report other types of miscellaneous income, such as rent payments, royalties, and other types of income. However, if a business pays non-employee compensation, they should use the 1099NEC form to report those payments.

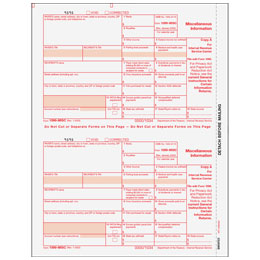

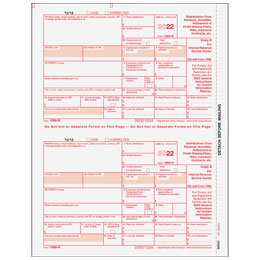

Our 1099MISC Tax Form sets come in 4 parts:

1099MISC Federal Copy A

1099MISC Receipient Copy B

1099MISC Payer Copy C &

1099MISC Payer State Copy 1

- Order 1099MISC preprinted sets if your software prints the data only.

- 1099MISC Sets include all forms required for filing with federal, and state authorities

- Each 8 1/2" X 11" sheet is perforated according to IRS regulations

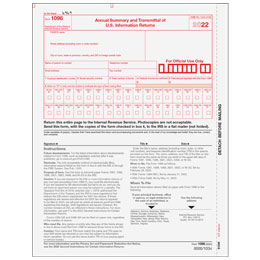

- Three FREE 1096 transmittal forms are included with your order

Order the quantity of 1099MISC sets equal to the number of recipients for which you file

Remember that these 1099MISC forms are for the current tax year only! We do not offer tax forms for previous tax years.