1099NEC

The 1099NEC form is used instead of the 1099MISC by businesses to report payments made to non-employees, such as independent contractors, freelancers, and other self-employed individuals. The form is used to report payments of $600 or more made to non-employees during the tax year.

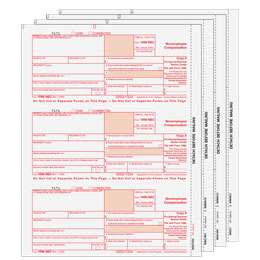

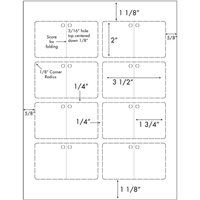

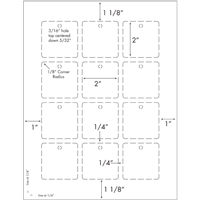

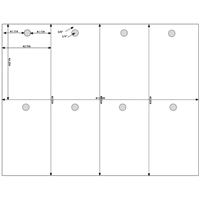

Our 1099NEC Tax Form sets are three per page and come in 4 parts:

1099NEC Federal Copy A

1099NEC Receipient Copy B

1099NEC Payer Copy C

1099NEC Payer State Copy 1

- Order 1099NEC preprinted sets if your software prints the data only.

- 1099NEC Sets include all forms required for filing with federal, and state authorities

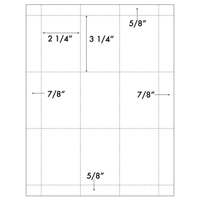

- Each 8 1/2" X 11" sheet is perforated according to IRS regulations

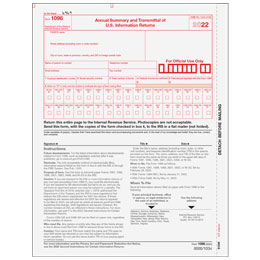

- Three FREE 1096 transmittal forms are included with your order

Order the quantity of 1099NEC sets equal to the number of recipients for which you file

Remember that these 1099NEC forms are for the current tax year only! We do not offer tax forms for previous tax years.